1. Introduction

As technology continues to shape our lives, it has also profoundly impacted the banking sector. Axis Omni Channel is at the forefront of this technological revolution, redefining how customers interact with their bank and conduct financial transactions.

2. Understanding Axis Omni Channel

2.1 What is Axis Omni Channel?

Axis Omni Channel is a cutting-edge banking concept that enables customers to carry out banking activities seamlessly across multiple channels. These channels include Internet banking, mobile banking, ATMs, social media, and physical branches. The key idea behind Axis Omni Channel is to provide customers with a unified and consistent banking experience, irrespective of the channel they choose.

2.2 The Evolution of Omni Channel Banking

The idea of Omni Channel banking is not entirely new. It has its roots in the multichannel approach, where banks offered different channels for customer interaction. However, with Omni Channel, the focus shifted to creating a more integrated and cohesive customer journey, reducing friction and enhancing convenience.

2.3 How Does Axis Omni Channel Work?

Axis Omni Channel works by leveraging advanced technologies like artificial intelligence, data analytics, and real-time communication. When a customer initiates a transaction through one channel, the information is instantly updated across all other channels, ensuring consistent and up-to-date information across the board.

3. The Benefits of Axis Omni Channel

3.1 Seamless Banking Experience

Axis Omni Channel ensures a seamless banking experience for customers. Whether they choose to visit a branch, use Internet banking, or access their accounts through a mobile app, the transition is smooth and hassle-free.

3.2 Personalization and Customer Engagement

Through data analysis, Axis Omni Channel enables personalized banking experiences. Customers receive tailored product recommendations and relevant offers based on their transaction history and preferences, fostering stronger customer engagement.

3.3 Accessibility and Convenience

With Axis Omni Channel, banking services are available 24/7, allowing customers to perform transactions at their convenience. Whether it’s transferring funds, paying bills, or checking account balances, customers have full access to their accounts whenever and wherever they require.

3.4 Enhanced Security Measures

Despite offering multiple channels, Axis Omni Channel prioritizes security. Advanced encryption and authentication protocols are in place to safeguard customers’ sensitive information and protect them from potential cyber threats.

3.5 Streamlined Financial Management

Axis Omni Channel allows customers to have a comprehensive view of their financial portfolio. They can track expenses, monitor investments, and manage savings through a single integrated platform.

4. Axis Bank Internet Banking: The Gateway to OMNI

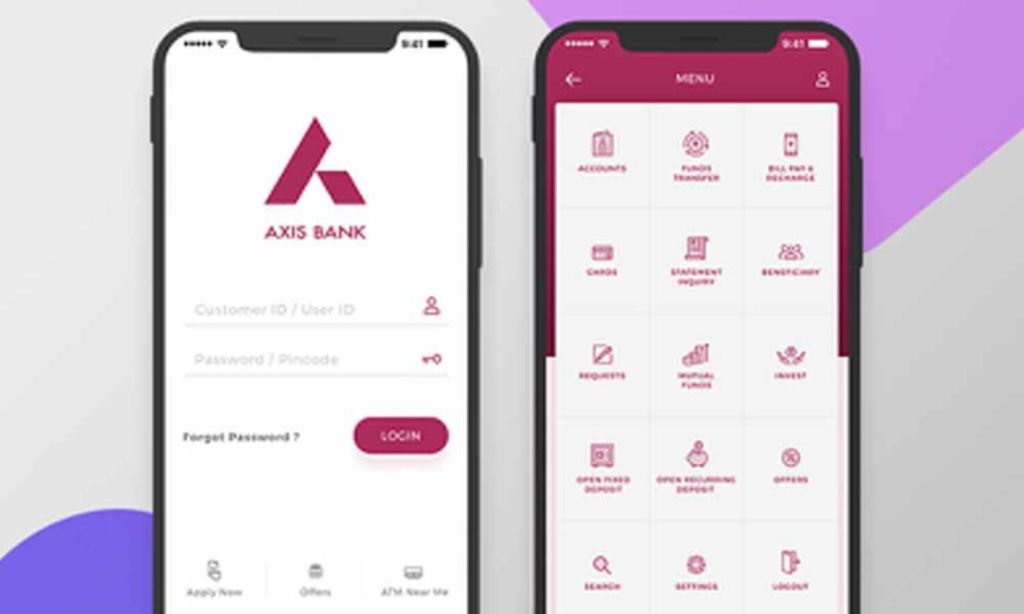

4.1 Exploring the Axis Bank Internet Banking Portal

Axis Bank Internet Banking serves as the primary access point to the Omni Channel experience. The platform offers a user-friendly interface, making banking operations intuitive and straightforward.

4.2 New Features and Updates

Axis Bank regularly updates its Internet Banking platform to incorporate the latest technological advancements and customer feedback. New features are introduced to enhance functionality and user experience continually.

4.3 The Future of Internet Banking with OMNI

The future of Internet Banking with Axis Omni Channel promises even more advanced features and seamless integration with other digital channels, making banking more intuitive and accessible than ever before.

5. The Role of Axis Omni Channel in Corporate Banking

Axis Omni Channel has also revolutionized corporate banking by streamlining financial workflows, simplifying transaction processes, and enabling businesses to make data-driven decisions.

6. Challenges and Solutions in Implementing Axis Omni Channel

6.1 Addressing Cybersecurity Concerns

As with any digital innovation, cybersecurity remains a top priority. Axis Bank continually invests in robust security measures to protect customer’s financial assets and sensitive information.

6.2 Ensuring User-Friendly Interfaces

The success of Axis Omni Channel depends on providing users with easy-to-navigate interfaces and intuitive features. Regular usability testing and customer feedback play a crucial role in enhancing user experience.

6.3 Integration of Traditional and Digital Banking

Harmoniously integrating traditional brick-and-mortar branches with digital channels is essential to maintain the trust and loyalty of all customer segments.

7. Industry Trends: A Look at Successful Omni Channel Strategies

Several other banks and financial institutions have also adopted Omni Channel strategies successfully. This section explores notable success stories and how they have transformed the banking landscape.

8. The Future of Banking with Axis Omni Channel

The future of banking is undoubtedly tied to the evolution of the Axis Omni Channel. As technology advances, we can expect more innovative features and a higher level of personalized banking experiences.

9. Conclusion

Axis Omni Channel has emerged as a game-changer in the banking industry. With its seamless integration of various channels, personalized experiences, and enhanced convenience, it has redefined how customers interact with their banks. As Axis Bank continues to innovate and adapt to changing customer needs, we can only expect a brighter future for banking with Axis Omni Channel.

Read More: Shah Rukh Khan Family: A Journey of Bollywood’s Baadshah

FAQs

Q: What makes Axis Omni Channel unique?

A: Axis Omni Channel stands out for its seamless integration of various banking channels, offering customers a unified experience.

Q: Is Axis Omni Channel secure?

A: Yes, Axis Omni Channel prioritizes security and deploys advanced measures to protect customer data.

Q: Can I access Axis Omni Channel outside of India?

A: Yes, Axis Omni Channel is accessible to customers worldwide, allowing them to perform banking operations from anywhere.

Q: What happens if there is a technical issue with one channel?

A: Axis Omni Channel’s real-time synchronization ensures that if one channel experiences technical difficulties, customers can seamlessly switch to another.

Q: How do I get started with Axis Omni Channel?

A: To access Axis Omni Channel, visit the Axis Bank website or download the mobile banking app and follow the registration instructions.