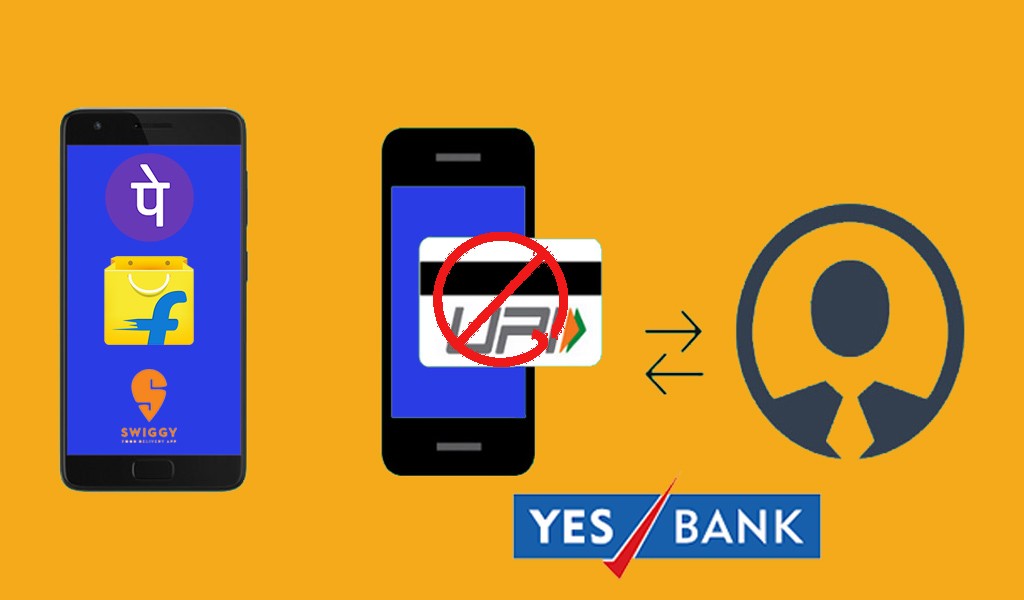

RBI imposed a one month ban on Yes Bank due to which customers are facing lots of problems. Moreover, due to this ban, PhonePe users are also facing issues as it is a partner of Yes Bank.

For the UPI transactions and other valuable services, PhonePe and Yes Bank are partners. However, due to one month ban, people started complaining on social media about how they were unable to use the application services. PhonePe later tweeted that this was due to maintenance activity.

We are temporarily unavailable.

We are going through an unscheduled maintenance activity. We apologize for any inconvenience this may cause.

We’ll be back soon.

— PhonePe (@PhonePe_) March 5, 2020

However, Sameer Nigam (CEO of PhonePe) posted on twitter that this was due to collapse of Yes Bank.

Dear @PhonePe_ customers. We sincerely regret the long outage. Our partner bank (Yes Bank) was placed under moratorium by RBI. Entire team’s been working all night to get services back up asap. We hope to be live in a few hours. Thanks for your patience. Stay tuned for updates!

— Sameer.Nigam (@_sameernigam) March 6, 2020

Other companies have also removed payment through Yes Bank from their portals. Swiggy has Yes Bank among the list of banks that support UPI payments, so Swiggy has removed the option to order food using the UPI account from the app. Similarly, Flipkart has also removed the option to pay using PhonePe. But these companies aren’t much affected just like PhonePe is. Moreover, people’s wallet balance is stuck in different portals which were connected with PhonePe. According to the reports, another startup named Yes Fintech is also affected.

Read More :- Supreme Court Of India Allows Trading Through Cryptocurrency

Yes Bank Crisis created panic among people

Along with the impact of this news on third-party app and payment platforms, Yes Bank’s app and Net Banking services are also halted. If someone has a YES bank account, then he/she will not be able to transfer the funds to another bank account. Apart from this, the person won’t be able to use Net Banking to pay anywhere. Yes Bank customer can withdraw only Rs 50,000 per month and this ban will be up to 3rd April, 2020.